Liquidation of the company employee benefits. Mandatory employee benefits upon liquidation

The liquidation of the enterprise leads to the complete cessation of its activities. As a result, employment contracts with employees are terminated. In this article, we will provide step-by-step instructions and describe the order in which the dismissal takes place in connection with the liquidation of the organization.

Turn to the law

But this does not end the relationship between employees and the employer - in accordance with article 178 of the Labor Code of the Russian Federation, the severance pay is paid to laid-off workers for another 2 months. This guarantee is provided for the material support of dismissed workers prior to their employment. Those who manage to find a new job earlier will lose their right to benefits from this moment on.

Term of receipt of severance pay can be extended for another month, if the former employee of the liquidated company, no later than 2 weeks after the dismissal, applied to the employment service, but could not find a job for the allotted 2 months.

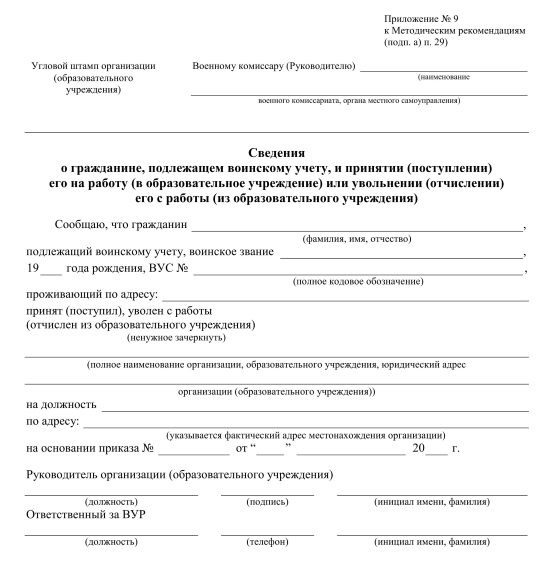

Step 8. We provide information to the military registration and enlistment office and the FSSP

If there are workers in the organization who are subject to military registration, information about their dismissal should be sent to the territorial military registration and enlistment office. This should be done no later than 2 weeks from the date of dismissal. The notification form can be obtained from the agency where information is provided (Appendix 9 to the Methodological Recommendations of the General Staff of the Armed Forces of the Russian Federation on keeping military records in organizations).

If there are employees in the organization for whom executive documents are in effect, information about their dismissal is immediately, in order to avoid a fine, sent to the territorial division of the FSSP where the enforcement proceedings are conducted. And executive documents are subject to return.

According to the Labor Code, payments for the liquidation of the company in 2017 are mandatory and provide for a certain procedure. In this case, the provisions are taken from the Legislation on the part of the Labor Code, as well as the Civil and Tax Code. Given the unstable economic situation in the country and the massive closure of various companies, this issue is highly relevant for several reasons:

First, the closure of the company provides for the dismissal of all employees without exception in the prescribed manner. This applies even to those who are on vacation, on a long hospital leave, on maternity leave, etc.

Secondly, legal entities announcing liquidation have a number of financial obligations to employees, which must be fulfilled no later than the last working day before dismissal.

And thirdly, in the event of the liquidation of the company 2017, employee benefits should be fully paid. We will discuss the main features of the process and the existing nuances further.

There is a list of mandatory payments provided Labor Code:

- Output allowance comparable in size with the average salary employee over the past year.

- Payments at the time of employment of the employee, but not more than two months from the date of dismissal. In some cases, this period may be extended for another month, if within two weeks the state has not been satisfied with the dismissal for a new job.

- Holiday.

- Compensation of other types provided by the LC RF.

Severance pay

Payments to employees in case of liquidation of an organization in the form of severance pay represent the amount of hours actually worked in the month when the decision to dismiss was made. In this case, the employee must receive the full amount no later than the last working day. If for some reason he was absent from the workplace, the right to disburse funds on demand is exercised.

The severance pay is compulsory and is the final settlement with the employee for his actual work in the enterprise, which announced liquidation.

Payments at the time of employment

As a rule, legal entities announcing their closure incur the greatest losses precisely from this type of mandatory payments. These payments during the liquidation of the enterprise are intended to compensate for the lost opportunity of earnings, dismissed for a period of up to two months. The size of payments is equal to the average salary of an employee for the last year. If he worked in the company less than the specified period, the arithmetic average is calculated based on the fact of the months worked.

However, there are cases where compensation does not pay. This is provided for in the Labor Code in situations where:

- An employee leaves at will;

- Reached mutual agreement on termination of the employment contract;

- The employee moves to another job.

Naturally, for an employer who has declared liquidation, these scenarios are most beneficial, and they seek to terminate the contract in this way by hook or by crook.

Holiday

In accordance with the current legislation of the Russian Federation, every person engaged in professional activities when formalized, has the right to leave, so vacation pay are also mandatory payments to an employee upon liquidation of the organization.

However, there are some subtleties that need to be remembered. For example, if a person for some reason did not use his right to leave, he should be paid compensation in case of liquidation in full. The same applies to the partial use of their right to leave.

If the issuance of vacation pay only for working days, the calculations are carried out accordingly. If for calendar - non-working days are also taken into account, including holidays and weekends. Even if the person is on vacation at the time of the announcement of the liquidation of the company, he has the right to demand his money. The payment is made under the signature in the statement, either by transfer to a bank account or a salary card.

Other compensation

If a decision is made to dismiss on liquidation of an enterprise, other payments are also obligatory. These include payment for sick leave, child care, compensation for harm, etc. All these points are provided for by the Labor Code of the Russian Federation.

It is worth noting the fact that the notification of the liquidation of the company, payments to employees and other organizational issues are carried out in a clearly defined time frame. Thus, a written notification of the closure of the organization to each employee must be issued no later than 60 days before the actual closure. And the last payment on each of the points stipulated by the TC, is made no later than the last day of work. The only exceptions are those situations where the employee is actually absent. In this situation, he can get his money on demand, but no later than the date of actual liquidation.

According to the Labor Code of the Russian Federation, dismissal upon liquidation of an organization, payments and other mandatory measures must be officially confirmed in documentary form. In the case of payment, this is the corresponding statement, and with dismissal - an order from the management.

So, we answered the question of what payments are due when the enterprise is liquidated to employees . Now you can use this information and assert your legal rights in case of a dispute.

Termination of an employment contract in connection with the closure of an enterprise is a special case when an employer has additional responsibilities. Dismissal upon liquidation of an organization is carried out using a special algorithm. In the material of the site you will also find information about what the payments are due for dismissal in connection with the liquidation of the organization.

Step 1. Notify employees

The complete liquidation of the company and the procedure for dismissing employees of the company provides for the termination of all existing agreements, contracts, contracts, including with employees. About the upcoming termination of relations of subordinates must be notified at least two months before the date of termination employment contracts. It is provided.

It is important that each employee must confirm in writing that he was notified of the impending breakup. That is, it is necessary to notify workers against signature. There is no prescribed form for such a notification, so an employer can use the option suggested below.

Approximate sample notice of subordinate

We emphasize that it is necessary to notify all employees without exception, including part-timers, seconded, persons who actually do not work (are on vacation, on maternity leave, on sick leave).

If the worker refuses to sign the notice or, for some reason, this document cannot be handed in, this circumstance must be recorded in the relevant act. The notification itself should be sent by registered letter with acknowledgment of delivery. This will further avoid many uncomfortable situations if an employee tries to show through the court that his dismissal was illegal.

Another small nuance. If an employee has a labor contract for a period of 2 months, notify him of the liquidation of the company no later than 3 days (). Seasonal workers should learn about termination of contracts at the initiative of the employer at least 7 days in advance ().

Step 2. We inform the employment service

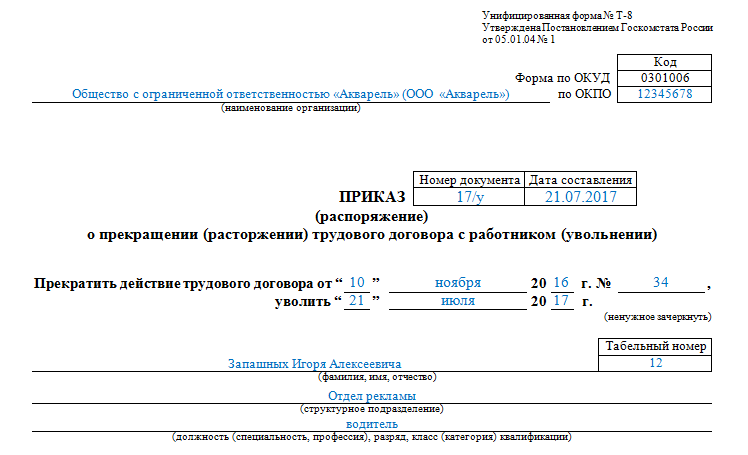

An example of an order to terminate an employment contract in connection with the termination of an enterprise

Step 4. Calculate and pay benefits and other amounts guaranteed by law

If a dismissal is made on liquidation of an enterprise, the payments to employees are as follows:

- earned during the month;

- compensation for unused in the current year vacation, including additional, if provided by law;

- severance pay.

By general rules, the permanent worker and the internal or external part-time worker have the full right to all amounts. At the same time, persons whose employment contracts are concluded for a period of up to 2 months () cannot claim for severance pay.

The amount of the severance pay is equal to the size of the average monthly earnings of the dismissed. At the same time, an employee is also provided with such a guarantee as the average monthly salary for the period of employment. It is paid within two months. By decision of the employment service, such material assistance will be able to get a dismissed for the third month if he does not find a job ().

Seasonal workers are entitled to compensation for the termination of an employment contract at the initiative of the employer only in the amount of a two-week average salary ().

All amounts must be paid on the last business day. If there was no subordinate, for example, he was on vacation, on a business trip or on sick leave, then he was entitled to pay the amounts due the next day after the application. This is spelled out in.

Step 5. We give documents related to work

The last thing to do is to give the employee a properly completed employment record and extracts from the SZV-STAGE and SZV-M forms.

Since the termination of the contract took place at the initiative of the employer, a corresponding entry should be made in the workbook. An example of such a record:

The proposed option is only one of the permissible and legal ways to make a record in the workbook upon termination of employment contracts in connection with the termination of the activities of a legal entity or an individual entrepreneur. If the previous entry was: “the employee is accepted to the driver’s position”, then the following should be: “dismissed at the initiative of the employer in connection with the liquidation of the enterprise”.

At the request of the worker, termination of the contract on other grounds is also permitted and, accordingly, there will be a different entry into the employment. For the employer, it is even beneficial, since the employee in this case loses the legal right to severance pay and money for the period of employment.

As for the extract from the form SZV-STAGE, it is issued simultaneously with the employment record book. For each employee, it is filled in separately. Sample of such an extract:

These are the basic rules that should be followed when dismissing subordinates in connection with the termination of the organization. Follow the described instructions for action and be able to avoid possible problems with disgruntled ex-workers and regulatory authorities.